Have you ever checked your credit picture only to spot something that made you scratch your head? Perhaps a record of a credit check appeared, seemingly out of nowhere, leaving you wondering what exactly happened. This feeling of surprise and confusion is actually quite common for many people who are simply trying to keep an eye on their financial standing.

It can be a little unsettling, you know, when you see a mark on your credit history that you don't recognize. Especially when you are absolutely sure you haven't recently asked for any new credit or submitted any paperwork for a loan. This kind of unexpected entry can really make someone feel a bit anxious about their financial well-being and how it might affect future plans.

Many folks discover these kinds of entries are often connected to companies like Credco or CoreLogic, which play a big part in how lenders look at your financial background. It's a system that, in some respects, can feel a bit mysterious from the outside, particularly when it comes to understanding how these specific checks work and what they mean for your overall credit health.

- Tanning Oil Tanning Bed

- Matching Brother And Sister Pajamas

- Matching Bridesmaids And Groomsmen

- Bowling Balls Michigan

- Wendy Snyder Husband

Table of Contents

- What's Going On With Unexpected Credit Checks?

- Why Do Credco/CoreLogic Seem to Make So Many Marks?

- Is It Really Fair to Get Lots of Credco/CoreLogic Inquiries?

- Removing or Just Blocking Those Marks?

- Making Sense of Credco/CoreLogic Scores

- Why Do Scores Look So Different?

- Credco/CoreLogic and Your Home Loan Process

- Can You Check Your Own Credco/CoreLogic Scores?

What's Going On With Unexpected Credit Checks?

Picture this: you're just going about your day, perhaps checking your financial reports, and then, boom! A record of a credit check appears on your file from a company called Credco, and you're absolutely sure you didn't ask for anything. This can be a really surprising moment, leaving you to wonder what on earth happened. It's a bit like finding an extra receipt in your wallet for something you never bought, you know? This unexpected record, often called a "hard inquiry," can feel quite jarring, especially when you're confident you haven't submitted any new applications for money or services that would require such a check. It makes you feel a little confused, and frankly, a bit concerned about who is looking at your private financial information without your direct permission or knowledge.

The immediate reaction for many people is usually a mix of disbelief and a slight feeling of panic. You start thinking about all the things you've done recently, trying to piece together how this could have happened. Could it be a mistake? Is someone else using your details? These are all very natural thoughts when faced with something so unexpected on your personal financial history. It's a situation that, in some respects, highlights how important it is to keep a close watch on your credit picture, even when you're not actively seeking new credit. The appearance of an uninvited mark from a company like Credco can certainly make you feel a bit vulnerable, and that's a perfectly understandable reaction.

Why Do Credco/CoreLogic Seem to Make So Many Marks?

So, you might be asking yourself, why would a company like Credco or CoreLogic be making these marks on your credit history, especially if you didn't directly ask them to? Well, basically, these companies often act as a sort of middleman. They gather up your credit history details on behalf of the folks who are thinking about lending you money. Imagine a loan giver, like a bank or a mortgage provider, needing to get a quick but thorough look at your financial background. Instead of them going directly to every single credit reporting agency, they might turn to a service like Credco or CoreLogic to pull all that information together for them.

- Stephanie Rodriguez Obituary

- Swimming Pool Sherman Tx

- Minty Drink Crossword Clue

- 2026 Libra Horoscope

- Fire Chemistry Experiments

What can be really startling, though, is when you see a whole bunch of these records from Credco all at once. Someone, for instance, mentioned seeing Credco had checked their credit ten times. That's a lot of separate marks to show up on your file, isn't it? It's almost as if they're doing the same thing over and over again, even if it's all for one main request from a loan provider. This way of operating, where one company makes many separate records of checks for a single purpose, can definitely make your credit file look a little busy, and that's a concern for many people.

These companies, in a way, simplify the process for lenders by giving them a combined view of your financial standing from different reporting agencies. However, the consequence for you, the individual, can be a surprising number of records of credit checks. It's really about how these information providers operate behind the scenes to serve the needs of loan givers, which sometimes results in what feels like an excessive number of individual credit check notations on your personal file.

Is It Really Fair to Get Lots of Credco/CoreLogic Inquiries?

When you see multiple records of credit checks from Credco or any similar organization on your credit history, it can feel truly out of line and not quite right. Someone expressed that it's just "insane and unfair" for any credit organization to place so many individual records of checks on a person's credit report. And you know, that sentiment is pretty understandable. Each of these "hard pulls" can, in some respects, nudge your credit standing down just a little bit. So, when you have ten of them show up, even if they're related to a single loan application, it can feel like a penalty for something that should only count once.

The common thinking is that when you're looking for a loan, like a home loan or a car loan, multiple checks within a short period, say a couple of weeks, should ideally be grouped together and count as just one overall check. This is because the credit scoring systems typically understand that people shop around for the best rates. But when a company like Credco seems to be making separate records for each piece of information they gather, it can really add up in a way that doesn't seem to reflect the actual situation. It leaves people feeling that the system isn't always set up to be completely fair to the individual who is just trying to get a good deal on a loan.

This situation can be quite frustrating because it feels like something beyond your direct influence is having an impact on your financial picture. The idea that a single process could lead to so many visible marks on your credit file is, for many, a point of genuine concern. It raises questions about how these systems are set up and whether they truly serve the best interests of the person seeking the loan, or if they are more focused on the data gathering methods of the providers like Credco/CoreLogic.

Removing or Just Blocking Those Marks?

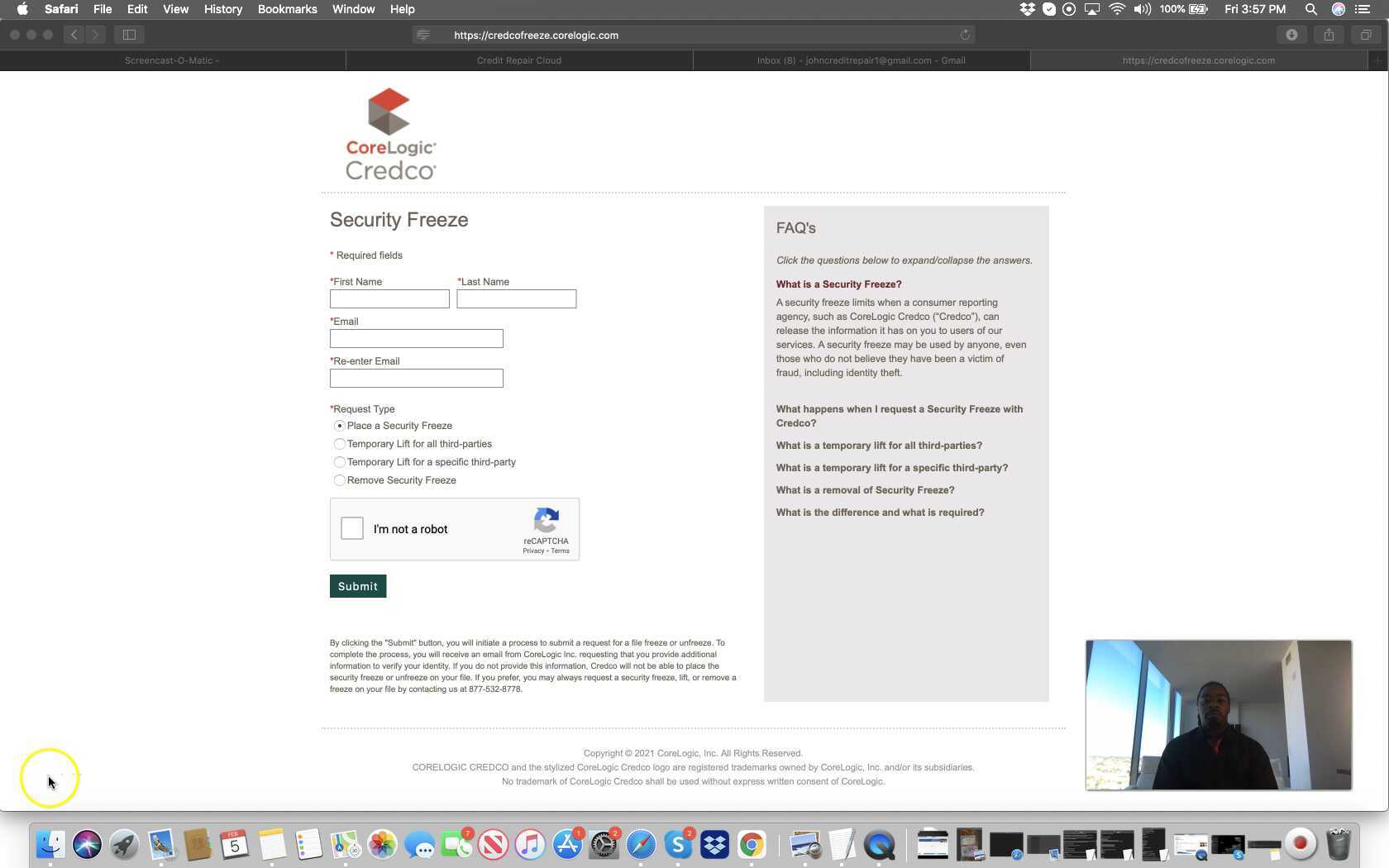

When you spot an unwanted record of a credit check, particularly from a company like Credco/CoreLogic, you naturally want to know what you can do about it. It turns out there are a couple of different approaches people talk about for dealing with these kinds of entries. One option is about getting the record completely taken off your file. This is like a full erasure, where the record simply disappears as if it was never there. This comprehensive removal is often what people hope for because it means the mark won't be visible to anyone looking at your credit history in the future, which is pretty much the ideal outcome.

The other approach is more about stopping the record from being seen. Instead of a full removal, this method is about making sure the mark is hidden or blocked from view. So, the record might still technically exist somewhere, but it won't show up when someone checks your credit. This could be useful in certain situations, but it's not quite the same as having it completely gone. It’s a bit like putting a privacy screen on a window versus actually taking the window out of the wall, you know? For many, the goal is to have any unfair or incorrect records from companies like Credco completely erased, rather than just hidden away.

The difference between these two ways of handling the records can be quite important for your overall financial picture. A complete removal means there's no trace left, which is generally preferred. A block, while helpful, might leave some lingering questions about whether the record could reappear or be accessed in a different way. It’s a matter of getting rid of the problem entirely versus just putting a temporary cover over it, which, for something as important as your credit standing, tends to make a big difference in how secure you feel about your financial information.

Making Sense of Credco/CoreLogic Scores

It can be truly perplexing when a company like Credco pulls a report on your credit, and you then feel like you need some help making sense of it all. People often find that the numbers they see from their own personal credit checks don't quite line up with what a lender, using a service like Credco, shows them. This difference can be a source of real confusion, especially when you're trying to get a clear picture of your financial health. It’s almost as if everyone is speaking a slightly different language when it comes to these credit numbers, and that can be quite frustrating for someone trying to understand their own standing.

The problem is that there isn't just one universal credit score out there. There are many different scoring models, and each one might weigh different aspects of your financial history a little differently. So, when Credco or CoreLogic provides a score to a loan provider, that score might be based on a specific model that the lender prefers, which could be quite different from the score you see when you check your own credit through a consumer-facing service. This lack of a single, consistent number can make it very hard to get a firm grasp on what your actual "score" is at any given moment, which is a bit of a challenge for anyone trying to manage their finances effectively.

This whole situation can make you feel a little bit in the dark, particularly when you are trying to align your expectations with what a loan provider might see. It's like trying to hit a moving target, you know? Understanding that companies like Credco use specific ways of calculating these numbers for lenders is a first step, but it doesn't always make the differing results any less confusing for the individual.

Why Do Scores Look So Different?

One of the most common and truly bewildering experiences people have is when their own credit scores look very different from the scores a loan provider gets, especially when that provider uses a service like Credco. Someone mentioned that their MyFICO credit scores varied greatly from the Credco scores that Wells Fargo used for a home loan refinancing rate. It's a bit like having two different thermometers showing completely different temperatures for the same room, which can make you wonder what the real temperature actually is. This discrepancy, where one's own score might be 50 points different from what a lender sees, is a significant gap and naturally causes concern.

The reason for these differing numbers often comes down to the fact that there are many different types of scoring models out there. Lenders, especially those dealing with home loans, frequently use very specific versions of credit scores that are designed to assess risk for that particular type of loan. For example, a home loan provider might use a FICO II score, which could weigh certain aspects of your credit history in a way that is different from a general FICO score you might get from a consumer service. So, while your personal score gives you a good general idea, the score a lender sees from Credco is often a highly specialized version, tailored to their specific lending needs. This can be quite a surprise for someone who expects a consistent number across the board.

This difference in scoring models means that even if your credit history is exactly the same, the number produced by a Credco report for a lender might just appear lower or higher than what you're used to seeing. It's not necessarily that your credit is worse, but rather that the calculation method is simply different. This really highlights why it's so important to understand that not all credit scores are created equal, and why the scores from a service like Credco can look so different from your personal ones.

Credco/CoreLogic and Your Home Loan Process

When you're in the middle of closing on a home, getting a home loan, or refinancing, any unexpected hiccup can make you feel quite anxious. Someone shared that they were "somewhat freaking out" because they were hoping to get FHA financing for a property they were about to complete the purchase of. To do this, they needed their credit picture to look just right. It's a very tense time, you know, with so many pieces needing to fall into place. In this situation, their home loan helper pulled a report from Credco, which showed their Experian FICO II score was 677. This is the specific number the lender would be looking at for that type of loan.

What makes this situation even more interesting is what happened later the same day. The person then went and pulled their own credit reports from the main agencies: Experian, Equifax, and TransUnion. They wanted to see for themselves what their numbers looked like. This comparison is a really common step for people, especially when they're trying to understand why a lender's score, provided by a service like Credco, might be different from what they can access themselves. It's about trying to reconcile those two different views of their financial standing, which, as we've discussed, can often show variations.

The role of companies like Credco/CoreLogic in the home loan process is pretty central. They provide the specific credit picture that loan givers rely on to make their decisions. So, while you might have a general idea of your credit standing, the numbers that truly matter for a home loan are often those pulled by these specialized services. It means that understanding how these specific reports work, and what numbers they focus on, can be pretty important when you're trying to secure a home loan.

Can You Check Your Own Credco/CoreLogic Scores?

It's a common question, and one that often leads to a bit of disappointment: Is there a way to see the exact credit scores that your loan provider sees, especially those pulled by services like Credco or CoreLogic? The simple answer, as someone pointed out, is that there's "no way to pull the scores my lender pulls to get an idea." This is because individuals, or "consumers," can't directly pull or run the specific kind of home loan credit report that a loan provider would use. It's a very particular kind of report, designed for lenders, and it's not something that's generally available for you to request for yourself.

This can feel a little frustrating, particularly when you suspect your score might be quite different from what your loan provider is seeing. For example, if your personal score is 50 points higher, it leaves you wondering why there's such a gap and if there's anything you can do to bridge it. You can, of course, regularly check your general credit scores from the main reporting agencies, like Experian, Equifax, and TransUnion. These give you a good overall picture of your financial health, and they are what you can directly access.

However, the precise numbers that a loan provider gets through a service like Credco or CoreLogic are typically proprietary to those specific lending models and are not made available for direct consumer access. So, while you can monitor your credit generally, getting the exact same report and score that a home loan provider sees is, in essence, not something you can do. It's a system that, in some respects, keeps those specific lender-focused numbers just out of reach for the individual, which is why it can be so hard to reconcile the different scores you might encounter.

This article has explored the common concerns surrounding unexpected credit checks from companies like Credco/CoreLogic, the reasons behind multiple inquiries, and the fairness of such practices. We've looked at the options for addressing these marks on your credit file, distinguishing between complete removal and blocking. We also discussed the confusion arising from differing credit scores, particularly between personal reports and those used by lenders like Credco for home loans, and why these variations exist. Finally, we touched on

Related Resources:

Detail Author:

- Name : Jana Hagenes

- Username : ondricka.zelma

- Email : skohler@yahoo.com

- Birthdate : 1979-03-09

- Address : 4889 Gordon View Suite 552 South Florianmouth, WI 69362-7770

- Phone : (843) 910-9164

- Company : Blick, Batz and Shanahan

- Job : Tool Set-Up Operator

- Bio : Consequatur ea commodi qui cum qui. Temporibus ex iusto dolores illo. Possimus voluptas quisquam omnis. Illum aut dolor iusto nam expedita eum.

Socials

instagram:

- url : https://instagram.com/kunzes

- username : kunzes

- bio : Consequatur consequatur voluptatem nihil ab eos maiores. Ea enim exercitationem atque blanditiis.

- followers : 4746

- following : 2876

tiktok:

- url : https://tiktok.com/@sunny_kunze

- username : sunny_kunze

- bio : Culpa aut voluptatem rerum officia est magnam. Veniam illo quia harum vero.

- followers : 278

- following : 1556

facebook:

- url : https://facebook.com/kunze2020

- username : kunze2020

- bio : Necessitatibus a rerum eos suscipit dicta sed quos ut.

- followers : 5298

- following : 463

linkedin:

- url : https://linkedin.com/in/kunzes

- username : kunzes

- bio : Alias sequi sapiente ut sit ipsa maiores.

- followers : 1090

- following : 470